System Administrators, Indiapost.

.

- Home

- INDIA POST

- eMAIL INDIAPOST

- ePOST

- SDC CHENNAI

- CEPT MYSORE

- PTC-FTP

- PTC MYSORE

- IPS WEB

- IPS WEB TRACKING

- UPU

- INTERNATIONAL POSTAL SITES

- KERALA POST

- KERALA POST FTP SITE

- TGY INFO PORTAL KERALA CIRCLE

- CHENNAIPOST

- WEST BENGAL CIRCLE

- FORMS

- POSTAL MANUALS AND SB ORDERS

- CCC

- SPEEDNET MIS

- RNET MIS

- EMO MIS

- EPAYMENT MIS

- ACCOUNTS MIS

- PARCELNET

- PROJECTARROW MONITORING

- CBS MONITORING

- INDIAPOST INFORMATION SITE

- SPCC OFFICE CONFIGURATION

- WIKIPEDIA

- POSTAL COMPLAINT REGISTRATION

- REGISTERED POST NSPC DASH BOARD

- SPEED POST NSPC DASHBOARD

- MGNREGA INDIA

- PROJECT ARROW WEB PORTAL

- NTES

- NATIONAL ADDRESS DATABASE MANAGEMENT SYSTEM

- RMFS

- RURAL RETAIL PRICE SURVEY(CPI)

- RMFS TRAINING

- IT MODERNISATION

- RTI MIS

- DOP eBanking

- NETWORK INTEGRATION PHASE II-DATA ENTRY

- PHILATELY

- RD AGENT PORTAL

- CBS CUSTOMER PORTAL

- PLI CUSTOMER PORTAL

- PLI AGENT PORTAL

- McCamish

- CRA-NSDL

- IRCTC

- RTI ONLINE

- GMAIL

- eTENDER

- NREGS

- GEOTAG INDIAPOST

- DELIVERY ZONE MAP CREATION

Wednesday, March 8, 2017

Monday, February 20, 2017

Friday, July 15, 2016

India Post plans separate firm to sell collectible stamps.

India Post is eyeing a jump of Rs. 100 crore in turnover from the philately segment.

It proposes to set up an independent public limited company to boost revenue.

The Department of Post is planning to set up an independent company for

its philately business with an aim to boost revenues from the sale of

collectible stamps.

India Post Philately Company is proposed as a public limited company,

fully owned by the government, with an authorised capital of Rs. 100

crore.

“The proposed company will be a service-based one, which will not only

sell its products to existing customers —collectors and philatelists —

but will also try to attract new ones. It will focus on promotion of

philately, mainly among the younger generation,” a senior official told The Hindu.

The proposal would soon be sent to the Cabinet.

Philately in textooks

As part of the strategy to spread the interest in philately among the younger generation, S.K. Sinha, Secretary, Posts, wrote to the Department of School Education and Literacy under the Ministry of Human Resources Development last month, seeking that a chapter on philately be included in the textbooks for Class V, VI, or VII.

As part of the strategy to spread the interest in philately among the younger generation, S.K. Sinha, Secretary, Posts, wrote to the Department of School Education and Literacy under the Ministry of Human Resources Development last month, seeking that a chapter on philately be included in the textbooks for Class V, VI, or VII.

India Post is eyeing a jump of Rs. 100 crore, or over 250 per cent, in

turnover from the philately segment to Rs. 141 crore in the current

fiscal.

The earnings from this segment stood at Rs. 39.88 crore during 2015-16 and Rs. 32.85 crore during 2014-15.

This does not include revenues from the sale of stamps meant for daily use.

As per the proposal, the new firm will have a corporate office and four

zonal offices. The board of directors will have seven officials. While

the Secretary, Department of Posts, will be the non-executive chairman,

India Post officials of the rank of Joint Secretary will be appointed as

chairman and managing director on deputation. The board will have three

persons from the department and four outsiders.

The Department of Company Affairs will also be represented on the board.

Inter-ministerial consultations will be held with the Departments of

Expenditure and Legal and Company Affairs, and their views would be

incorporated in the Cabinet note.

In the six months from January to June this year, the Department has issued 14 commemorative stamps.

courtesy:-http://www.thehindu.com

Bottled Ganga Jal Is An Instant Hit At Post Offices.

The wait is over for millions, the bottled drink of the season is here. Weeks after Union minister Ravi Shankar Prasad promised

to have Ganga jal delivered to people's doorsteps through the postal

system, the scheme took off with a splash. The service was launched in Patna on Sunday with much fanfare. Considered holy by millions of Hindus across the world, the water

from River Ganga is much sought after, in spite of alarming levels of

pollution associated with it. The river is not only a vast dumping

ground for industrial and human wastes but in some parts the remains of

the dead are also submerged in it after the last rites. A team of

scientists is working in Varanasi, one of the holiest cities for Hindus,

to find out the exact levels of pollution, which they intend to make public soon.

Millions of Hindus undertake pilgrimages to holy sites to bring back

months' supply of the water from the river. Life has been made

infinitely simpler for these believers by the Indian government, as

holiness can now be purchased from local post offices, packaged

hygienically, for a pittance.

A limited number of bottles of 'pure Ganga jal' was dispatched to

over 800 post offices across the country to cater to what Prasad called

the "cultural needs" of the people. But his government seemed to have

misjudged the demand for this sacred potion, believed to be a panacea

for most evils.

Thursday, April 7, 2016

PLI , RPLI Manual Calculators for CPCs.

- RPLI Premium Cum Profit Calculator

- PLI Premium Cum Profit Calculator

- Loan Full calculator

- Loan partial calculator

Click below link to download the manual calculators in r/o the following:

Thanks to:

Shri. B.Venkatesan, PA CPC,

Melakavery HO, TN

email : sbvenkat2008@gmail.com and potools.blogspot.in

Tuesday, March 8, 2016

India Post to approach RBI for interoperability of ATMs.

NEW DELHI: Department of Post (DoP) will soon approach Reserve Bank for interoperability of its ATMs with commercial banks as it looks to roll out 10,000 ATMs across the country by the end of this year. A DoP official told PTI that Communications and IT Minister Ravi Shankar Prasad has asked the department to take the proposal to RBI on priority basis as it will help in popularising banking in rural areas.

he official added that India Post will be rolling out 10,000 ATMs and 20,000 micro ATMs across the country by the end of this year. Interoperability of postal ATMs will help people to withdraw money from their bank accounts also. Currently, such ATMs can be used if people have an account in DoP.

The government wants to leverage the vast network of India Post for implementing the mandate of financial inclusion and it has received renewed momentum from the Budget recommendations. Finance Minister Arun Jaitley has announced in his Budget speech for 2016-17 that to provide better access to financial services, especially in rural areas, the government will undertake a massive nationwide rollout of ATMs and micro ATMs in post offices over the next three years. DoP has already announced plans to open 1,000 ATMs by March.

India Post has more than 576 ATMs across the country and has also overtaken the State Bank of India to become India's largest core banking network having 18,231 branches.

By March, all the 25,000 departmental post offices would offer anywhere banking facilities using core banking solutions. As on February, India Post has issued 1,26,181 ATM/debit cards to its account holders.

The Public Investment Board has already approved the Rs 800-crore proposal from India Post for setting up a payments bank. PIB, under the Finance Ministry, vets the investment proposals by state-run entities.

The department is also in the process of finalising selection of a consultant for setting up of the India Post payments bank. India Post payments bank will primarily target unbanked and under-banked customers in rural, semi-rural and remote areas, with a focus on providing simple deposit products and money remittance services.

The pilot for the payments bank is set to start from January and the full-fledged operations may start by March 2017. As many as 40 international financial conglomerates including World Bank and Barclays have shown interest to partner the postal department for setting up the bank.

Reserve Bank has granted payments bank permit to the department, which is already into providing financial services and has 1.55 lakh branches across the country.

Thursday, February 18, 2016

Tuesday, February 16, 2016

C B S Finacle Work Flow Process with B O Transactions - 5th Edition ( 12.02.2016).

C B S Finacle Work Flow Process with B O Transactions - 5th Edition ( 12.02.2016) - Prepared by CBS CPC, Odisha Circle

CLICK HERE TO VIEW THE DOCUMENT.

Courtesy:-http://pofinacleguide.blogspot.in

CPC Odisha Circle.

‘IndiaPost’s core banking system beats SBI in size’

MUMBAI: The department of posts now has a core banking system that is bigger than that of SBI, Union IT and communications minister Ravi Shankar Prasad has said. The minister's statement comes at a time when IndiaPost is in the process of launching a payments bank. Infosys had bagged a multi-year Rs 700-crore deal from the department to implement its core banking solution Finacle connecting 1.5 lakh post offices with 20 crore customer accounts in 2012.

Until now, SBI's core banking system implemented by TCS was the largest in the country and also the largest centralized core system implementation ever undertaken. The bank has 16,498 branches and 57,986 ATMs.

However, even this large network pales in comparison to IndiaPost's network. While the post office has a larger network, the accounts are more in the nature of savings and SBI's core system is much more complex as it handles millions of transactions every day. The bank has also built a data warehousing and analytics layer over the core banking platform whereas IndiaPost has completed the first leg of networking.Speaking at a special session at the Make in India week, Prasad said that the department would soon launch a payments bank. The minister said that around 60 domestic and international entities had evinced interest in partnering with the department. Prasad launched a 'fund-of-funds' aimed at helping startups from the electronics and IT sector create intellectual property. The government would invest up to Rs 2,200 crore in the initiative which would be in the form of a public-private partnership. The Electronic Development Fund is floated by the Department of Electronics and Information Technology.

Courtesy:-http://timesofindia.indiatimes.com/

Pineapple -- India Post Finacle Guide by POUpdates

Hello and welcome from PO Updates. Its time to say goodbye to all your finacle problems. Pineapple has come to your rescue. PINEAPPLE is a comprehensive step by step guide for all transactions in India Post finacle. We have created this book so that you can use it while doing your daily transactions. All procedures are up to date. We have also included a section of common issues and solutions which you will find extremely useful. If you have any suggestions and/or if you find any mistakes in the book do contact us. We will rectify them in our future editions. Wish you good luck.

Click Here to download the book.

Download the book and take a print out. The book contains 126 pages. We have optimized the book for back to back printing. So if possible take back to back printouts.

If you like this book and find it useful you can show us your appreciation by downloading our android app. Download the app and do not uninstall it please. The app by itself is extremely useful. That's the least you can do for us.

Thanks to Team of PO Updates.

Courtesy : https://poupdates.blogspot.in/

Thursday, February 11, 2016

India Post to invest Rs 322 crore to augment parcel capacity.

NEW DELHI: In a bid to strengthen its position in the e-commerce market, India Post has proposed to invest Rs 322 crore till 2019-20 to augment parcel handling capacity through which it projects to earn a revenue of Rs 1,608 crore.

An official in the Department of Post told PTI that with the current pace of growth in e-commerce segment, India Post would be handling 40 lakh parcels per month in the near future and the capacity needs to be augmented accordingly.

"The Department is proposing to invest Rs 322 crore in the period from 2015-2016 to 2019-20 to augment and develop parcel handling capacities," the official said. He said India Post centres would be equipped with modern handling devices, conveyor belt and security systems to ensure faster and safe processing. He added volumetric measurement system will also be introduced to ensure revenue based on volume of the consignment having lesser weight but occupying larger space in trans-shipment. "With the proposed investments, the revenue projections from e-commerce in all segments is Rs 1,608 crore in five years," he said.

In order to cater to the parcel business, the department proposes to set up automated mail processing centres at Mumbai, Chennai, Bengaluru and Hyderabad with mixed mail sorter and parcel sorter at each location. The official further said the department is implementing a global positioning system (GPS) in its departmental mail motor vehicles in all the major centres. The IT modernisation project for India Post is under implementation which would result in electronically connected urban and rural network. "It would allow increased consistency and reliability in mail, parcels and logistics delivery system in line with global standards," he said. The department has also initiated a project for parcel network optimisation for developing a comprehensive business and marketing plan based on current trends in the e-commerce market.

An official in the Department of Post told PTI that with the current pace of growth in e-commerce segment, India Post would be handling 40 lakh parcels per month in the near future and the capacity needs to be augmented accordingly.

"The Department is proposing to invest Rs 322 crore in the period from 2015-2016 to 2019-20 to augment and develop parcel handling capacities," the official said. He said India Post centres would be equipped with modern handling devices, conveyor belt and security systems to ensure faster and safe processing. He added volumetric measurement system will also be introduced to ensure revenue based on volume of the consignment having lesser weight but occupying larger space in trans-shipment. "With the proposed investments, the revenue projections from e-commerce in all segments is Rs 1,608 crore in five years," he said.

In order to cater to the parcel business, the department proposes to set up automated mail processing centres at Mumbai, Chennai, Bengaluru and Hyderabad with mixed mail sorter and parcel sorter at each location. The official further said the department is implementing a global positioning system (GPS) in its departmental mail motor vehicles in all the major centres. The IT modernisation project for India Post is under implementation which would result in electronically connected urban and rural network. "It would allow increased consistency and reliability in mail, parcels and logistics delivery system in line with global standards," he said. The department has also initiated a project for parcel network optimisation for developing a comprehensive business and marketing plan based on current trends in the e-commerce market.

In e-commerce space, India Post is serving more than 400 small- and medium-level customers spread all across the country including all major players like Amazon, Flipkart, Myntra, Snapdeal, Paytm, Shopclues, Yepme, Naaptol, Telebrands and Homeshop18, among others.

courtesy:-http://economictimes.indiatimes.com

Wednesday, January 27, 2016

DNS Flushing technique to boost up DOP Finacle speed

What does DNS flushing do?

Whenever you type a URL on the adress bar it fetches the corresponding

IP address to communicate with web server (it might be any kind of

server). When you repeatedly use a same URL its just a waste of network

resource to fetch corresponding IP address every time because IP don't

change too often.

So your computer stores the combinations of domain name and its IP in

local cache to avoid fetching from Domain name System(DNS) every time

you use same domain name(URL).

It also holds another crucial info called "Timeout" which says about the

valid time for the IP and domain name combination, when this time times

out your computer re-fetches the combination from DNS and stores in

local cache again.

DNS flushing is the mechanism where the user can manually make all the

entries in the cache invalid, so your computer re-fetches new

combinations by now on whenever it needs and stores in local

Enough theory, let us do some practical

- First click Windows+R keys in your key board.(Ref the image given below)

Type the following command and press Enter:

ipconfig /flushdns

If the command was successful, you will see the following message:

Now start a new session in Finacle and see the magic.It will be faster

than previous session. This technique is useful in afternoon when the

Finacle shows sluggish behavior.

Courtesy:dopfinacle.blospot.in

Thursday, January 7, 2016

India Post Bank to open doors in March 2017 with Infosys Finacle.

India Post Bank has been given the go-ahead to start processing payments in 2017 following a number of lengthily delays.

The post office’s financial services are seen as a viable provider for India’s rural population, of which a majority do not have access to banking.

230 million Indians, however, do hold savings accounts with the Post Office, which has 139,144 locations across rural areas of the country.

Ravi Shankar Prasad, union minister for communications and IT, announced that a March 2017 start date had been fixed for the banking arm to begin processing. He also noted Deutsche Bank and the World Bank had expressed interest in partnerships.

Waiting times

India Post has been waiting a long time for the green light to set up its own bank. It originally planned to start offering services in March 2014 as part of an enterprise-wide transformation fuelled by Infosys’ Finacle core system.

Finacle was selected by the company following a process that began in 2010 and was charged with turning post offices across India into ‘mini banks’ catering to an average of 7,000 customers each.

The project, which cost around $125.3 million, had an initial completion date of July 2014.

Stumbling blocks

India Post encountered a number of stumbling blocks, however, most notably when the country’s finance ministry opposed the banking services plan in February 2014, claiming the company did not have the necessary expertise to become a bank proper.

Ageing data – with some tables up to 100 years old – and a worry about Post Bank customers and tellers being confused with the modern Finacle system were among other pressing concerns.

The Reserve Bank of India has since brought about the reversal of the finance ministry’s decision and come out in favour of the plans.

Pilot plans

India Post has already run a number of pilot projects in Assam, Uttar, Pradesh and Maharashtra to test the capabilities of its new system.

With 41% of India’s population not using banking services, it is hoped that the 2017 go-live will encourage financial inclusion across the country.

IndiaPost serves notice to Birla MF over radio ad.

MUMBAI: The Department of Posts served a notice this week to Aditya Birla Group and Big FM Radio Channel over a radio advertisement for Birla Sun Life Mutual Funds. The department has demanded an apology and wants the advertisement - which it claims disparages 'registered post' and 'speed post' services - to be taken off air.

The Hindi radio ad in question begins with a boss asking an employee to urgently send a mail. The employee responds by asking whether he should choose 'registered post' or 'speed post'. The voice on the radio goes on to describe the services as 'sust' (lethargic) methods which do not help in reaching your destination in time. It then goads listeners to choose mutual funds which are effective investment tools. Although the intention of the advertisement appears to be aimed at comparing electronic mail with physical mail, it does not expressly say so. Also, the description of 'registered post' and 'speed post' as lethargic has rankled the department.

According to sources, The department is upset because it feels that the ad perpetuates a misconception about 'registered post' and 'speed post' services, which have been audited by the CAG and certified to be superior to private courier services. When queried about the notice, P N Ranjit Kumar, postmaster general (Mumbai), said, "Department of Posts will not take kindly to attempts to malign its products and we will do whatever is required to protect the value of its brands."

The advertisement comes at a time when IndiaPost is seeking to revise its profile as an efficient logistics and financial services provider. The department is one of the recipients of an in-principle approval for a payments bank licence. Incidentally, the Aditya Birla Group has also received an in-principle approval for a payments bank from the Reserve Bank of India.

The Hindi radio ad in question begins with a boss asking an employee to urgently send a mail. The employee responds by asking whether he should choose 'registered post' or 'speed post'. The voice on the radio goes on to describe the services as 'sust' (lethargic) methods which do not help in reaching your destination in time. It then goads listeners to choose mutual funds which are effective investment tools. Although the intention of the advertisement appears to be aimed at comparing electronic mail with physical mail, it does not expressly say so. Also, the description of 'registered post' and 'speed post' as lethargic has rankled the department.

According to sources, The department is upset because it feels that the ad perpetuates a misconception about 'registered post' and 'speed post' services, which have been audited by the CAG and certified to be superior to private courier services. When queried about the notice, P N Ranjit Kumar, postmaster general (Mumbai), said, "Department of Posts will not take kindly to attempts to malign its products and we will do whatever is required to protect the value of its brands."

The advertisement comes at a time when IndiaPost is seeking to revise its profile as an efficient logistics and financial services provider. The department is one of the recipients of an in-principle approval for a payments bank licence. Incidentally, the Aditya Birla Group has also received an in-principle approval for a payments bank from the Reserve Bank of India.

Saturday, November 21, 2015

Highlights of the 7th CPC for Department of Posts Employees :

Postal Services Board :

The

Commission has examined the demand for granting apex level to the

members of the PSB and is of the view that adequate functional

justification for the same does not exist. ( Para 11.8.11)

The

Commission however is no t in favour of creating an additional post of

member to discharge the financial function and is of the view that the

portfolios of the six members can be so re-arranged that the need to

create a new post of Member is obviated. ( Para 11.8.12)

IPS (Group – A):

In so far

as Director, National Postal Academy is concerned, the view taken is

that functional justification from upgrading the post to Apex level does

not exist. As far as the rest of the demands for upgradation / creation

of posts are concerned, these are administrative matters, which may be

taken up with the concerned departments in the government. ( Para

11.8.15)

Postmaster Cadre :

The

Commission recommends that while 25 percent of the posts of Senior Post

Master may continue to be filled up from Post Master Gr.III through

seniority based promotions, eligible officers from the Post Masters’

cadre (Postmaster Gr.II and Postmaster Gr.III) may also be permitted to

appear for LDCE along with Inspector (Posts) for the balance 75 percent

of the Senior Postmasters’ posts ( Para 11.8.18)

Inspector Cadre :

The

Commission, therefore, recommends that Inspector (Posts) who are

presently in the GP 4200 should be upgraded to GP 4600. With this

upgradation, Inspector (Posts) shall come to lie in an identical grade

pay as that of their promotion post of Assistant Superintendent of Posts

(ASPOs). A higher grade would thus need to be extended to ASPOs.

Accordingly, the Commission recommends that the promotional post of

ASPOs be placed in the next higher GP 4800 and further, the post of

Superintendent (Posts), which is presently in the GP 4800, be moved up

to GP 5400 (PB-2). ( Para 11.8.21)

Postal Assistants / Sorting Assistants / LSG / HSG-II / HSG-I:

The

Commission is of the view that there is no justification

for enhancement of minimum educational qualifications for Direct

Recruits for Postal Assistants/Sorting Assistants from Class XII to

Graduation and the entry grade pay from GP 2400 to GP 2800. No

justification for upgrading LSG, HSG-II & HSG-I (Para 11.8.23 &

11.8.24)

P A ( SBCO) :

The

Commission is therefore of the view that no upgradation is warranted.

As regards grant of cash handling allowance, the Commission is of the

view that with the spread of banking and internet based payments coming

into vogue there is no merit in granting an allowance for handling cash.

( Para 11.8.27).

Postman :

The

Commission has noted the entry level qualifications prescribed (Class X

or ITI for MTS) as also the work content, and is of the view that there

is no justification for further raising the entry grade pay of Postman. (

Para 11.8.29)

Mail Guard :

As no

modification in the grade pay of Postman is recommended, the Mail Guard

shall also be placed in same pay level. ( Para 11.8.33)

Multi Tasking Staff :

No upgrade is considered necessary for either MTS-domestic or MTS-foreign posts. ( Para 11.8.37)

Binders :

There is no justification for raising the entry grade pay as sought. ( Para 11.8.39)

Artisans :

The

Commission is of the view that no anomaly exists in the present pay

structure of these posts. The cadre of artisans in the Department of

Posts shall accordingly be extended only the corresponding replacement

level of pay. ( Para 11.8.43)

Translation Officer :

The

Commission, therefore, suggests that a comparative study of the job

profiles be carried out by the department to arrive at the precise job

content and a view taken thereafter. ( Para 11.8.45)

Technical Supervisors :

No upgrade is recommended. (11.8.47)

Gramin Dak Sewaks:

The Commission has carefully considered the demand and noted the following:

a. GDS are Extra-Departmental Agents recruited by Department of Posts to serve in rural areas.

b. As per the RRs, the minimum educational qualification for recruitment to this post is Class X.

c. GDS are required to beon duty only for 4-5 hours a day under the terms and conditions of their service.

d. The GDS

are remunerated with Time Related Continuity Allowance (TRCA) on the

pattern of pay scales for regular government employees, plus DA on

pro-rata basis.

e. A GDS must have other means of income independent of his remuneration as a GDS, to sustain himself and his

Government

of India has so far held that the GDS is outside the Civil Service of

the Union and shall not claim to be at par with the Central Government

employees. The Supreme Court judgment also states that GDS are only

holders of civil posts but not civilian employees.

The Commission endorses this view and therefore has no recommendation with regard to GDS. ( Para 11.8.49 & 11.8.50)

Separate Cadre for S As / M Es :

System

Administrators and Marketing Executives have demanded creation of

separate cadres with higher pay scales. Presently incumbents of these

posts are drawn from the cadre of Postal Assistants/Sorting Assistant

Cadre.

The V and

the VI CPC have also dealt with this issue and have not recommended

separation of cadres. The Commission also does not see any rationale for

creating separate cadres. (Para 11.8.51 & 11.8.52)

Easy steps to Calculate your 7th Pay Commission New Pay Scale.

Know Easy steps to Calculate your 7th Pay Commission New Pay Scale

7th Pay commission simplified the calculation for arriving revised Pay through new 7th CPC Pay Metrix

Lat us Assume you are drawing Grade Pay Rs.4200 and Pay in the Band Pay Rs.12110

To calculate your Basic Pay and Allowance follow the steps given below.Step-I

Calculate your sixth CPC basic Pay

( Grade Pay + Band Pay) = 4200+12110= 16310

Step-II ( Grade Pay + Band Pay) = 4200+12110= 16310

Multiply the above figure with 7th CPC Fitment Formula 2.57

16310 x 2.57 = 41916.70 . ( Paisa to be rounded off to the nearest Rupee)

The Ans is = Rs.41917

Step-III

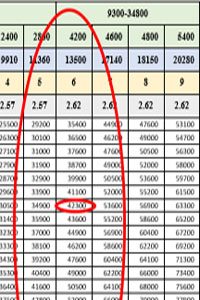

Match this Answer with Matrix Table ( Given Below) Figures assigned in Grade Pay column Rs.4200

There is no matching figure we arrived

above in this matrix, so the closest higher figure assigned in the Grade

Pay column can be chosen ie is Rs. 42300

So , Rs 42300 is your New 7th CPC Basic Pay

Step-IVIdentify your HRA [ See : 7th Pay commission recommendation on HRA]

HRA has been revised as 24%, 16% and 8% for 30% , 20% and 10% respectively

So if you are in 30% HRA Bracket, your HRA in 7th CPC is 24% vis versa.

Let us assume now you are in 30% HRA bracket, your revised HRA is 24%

Find the 24% of the Basic Pay = 42300 x 24/100 = 10152

Your HRA is Rs.10152

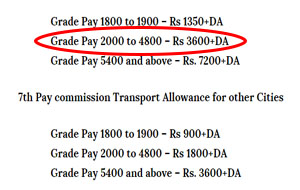

Step-VIdentify your TPTA (Transport Allowance)

7th CPC Recommends Transport Allowance for three Category of Employees for Two Types of Places

If you are living in A1 and A classified cities (See the List of 19 cities classified as A1 and A cities) you will be entitled to get higher TPTA rates

And since your Grade Pay is 4200 you fall in Second category

ie Grade Pay 2000 to 4800 – Rs 3600+DA

Your TPTA is Rs. 3600/- (DA is Nil as on 1.1.2016)

Step-VI

(Sine DA will be Zero from 1.1.2016 So no need to calculate the DA to calculate 7th Pay and Allowances from 1.1.2016)

Add all the figures

New Basic Pay + HRA+TPTA = 42300+10152+3600 = 56052

Your revised 7th CPC Grass pay as on 1.1.2016 = Rs.56052

courtesy: http://www.gservants.com

courtesy: http://www.gservants.com

Subscribe to:

Posts (Atom)