Postal Services Board :

The

Commission has examined the demand for granting apex level to the

members of the PSB and is of the view that adequate functional

justification for the same does not exist. ( Para 11.8.11)

The

Commission however is no t in favour of creating an additional post of

member to discharge the financial function and is of the view that the

portfolios of the six members can be so re-arranged that the need to

create a new post of Member is obviated. ( Para 11.8.12)

IPS (Group – A):

In so far

as Director, National Postal Academy is concerned, the view taken is

that functional justification from upgrading the post to Apex level does

not exist. As far as the rest of the demands for upgradation / creation

of posts are concerned, these are administrative matters, which may be

taken up with the concerned departments in the government. ( Para

11.8.15)

Postmaster Cadre :

The

Commission recommends that while 25 percent of the posts of Senior Post

Master may continue to be filled up from Post Master Gr.III through

seniority based promotions, eligible officers from the Post Masters’

cadre (Postmaster Gr.II and Postmaster Gr.III) may also be permitted to

appear for LDCE along with Inspector (Posts) for the balance 75 percent

of the Senior Postmasters’ posts ( Para 11.8.18)

Inspector Cadre :

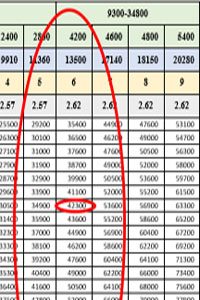

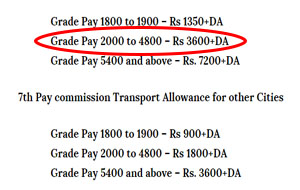

The

Commission, therefore, recommends that Inspector (Posts) who are

presently in the GP 4200 should be upgraded to GP 4600. With this

upgradation, Inspector (Posts) shall come to lie in an identical grade

pay as that of their promotion post of Assistant Superintendent of Posts

(ASPOs). A higher grade would thus need to be extended to ASPOs.

Accordingly, the Commission recommends that the promotional post of

ASPOs be placed in the next higher GP 4800 and further, the post of

Superintendent (Posts), which is presently in the GP 4800, be moved up

to GP 5400 (PB-2). ( Para 11.8.21)

Postal Assistants / Sorting Assistants / LSG / HSG-II / HSG-I:

The

Commission is of the view that there is no justification

for enhancement of minimum educational qualifications for Direct

Recruits for Postal Assistants/Sorting Assistants from Class XII to

Graduation and the entry grade pay from GP 2400 to GP 2800. No

justification for upgrading LSG, HSG-II & HSG-I (Para 11.8.23 &

11.8.24)

P A ( SBCO) :

The

Commission is therefore of the view that no upgradation is warranted.

As regards grant of cash handling allowance, the Commission is of the

view that with the spread of banking and internet based payments coming

into vogue there is no merit in granting an allowance for handling cash.

( Para 11.8.27).

Postman :

The

Commission has noted the entry level qualifications prescribed (Class X

or ITI for MTS) as also the work content, and is of the view that there

is no justification for further raising the entry grade pay of Postman. (

Para 11.8.29)

Mail Guard :

As no

modification in the grade pay of Postman is recommended, the Mail Guard

shall also be placed in same pay level. ( Para 11.8.33)

Multi Tasking Staff :

No upgrade is considered necessary for either MTS-domestic or MTS-foreign posts. ( Para 11.8.37)

Binders :

There is no justification for raising the entry grade pay as sought. ( Para 11.8.39)

Artisans :

The

Commission is of the view that no anomaly exists in the present pay

structure of these posts. The cadre of artisans in the Department of

Posts shall accordingly be extended only the corresponding replacement

level of pay. ( Para 11.8.43)

Translation Officer :

The

Commission, therefore, suggests that a comparative study of the job

profiles be carried out by the department to arrive at the precise job

content and a view taken thereafter. ( Para 11.8.45)

Technical Supervisors :

No upgrade is recommended. (11.8.47)

Gramin Dak Sewaks:

The Commission has carefully considered the demand and noted the following:

a. GDS are Extra-Departmental Agents recruited by Department of Posts to serve in rural areas.

b. As per the RRs, the minimum educational qualification for recruitment to this post is Class X.

c. GDS are required to beon duty only for 4-5 hours a day under the terms and conditions of their service.

d. The GDS

are remunerated with Time Related Continuity Allowance (TRCA) on the

pattern of pay scales for regular government employees, plus DA on

pro-rata basis.

e. A GDS must have other means of income independent of his remuneration as a GDS, to sustain himself and his

Government

of India has so far held that the GDS is outside the Civil Service of

the Union and shall not claim to be at par with the Central Government

employees. The Supreme Court judgment also states that GDS are only

holders of civil posts but not civilian employees.

The Commission endorses this view and therefore has no recommendation with regard to GDS. ( Para 11.8.49 & 11.8.50)

Separate Cadre for S As / M Es :

System

Administrators and Marketing Executives have demanded creation of

separate cadres with higher pay scales. Presently incumbents of these

posts are drawn from the cadre of Postal Assistants/Sorting Assistant

Cadre.

The V and

the VI CPC have also dealt with this issue and have not recommended

separation of cadres. The Commission also does not see any rationale for

creating separate cadres. (Para 11.8.51 & 11.8.52)